Trading the Bullish and Bearish Measured Move Patterns Forex Training

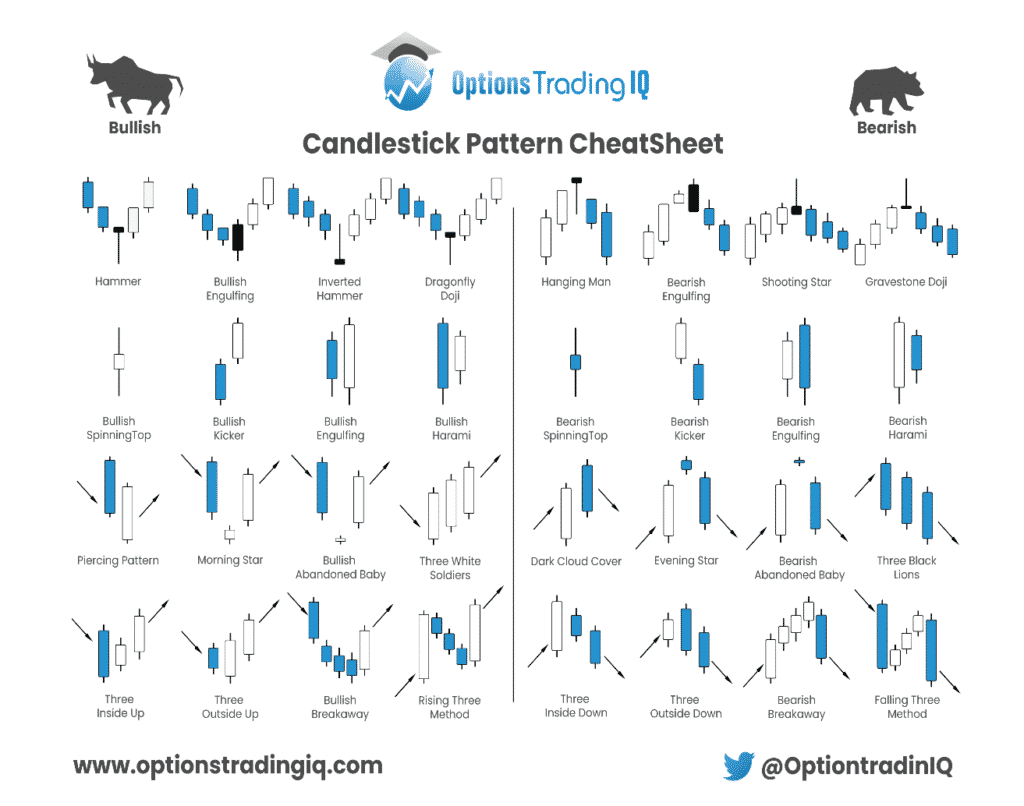

provide an early indication of a reversal from a bullish to a bearish trend, typically with an opening price at or a gap above the close of the previous candle (a gap indicates space between the body of the previous candle and the open of the consequent candle). The pattern represents a potential top, and therefore a potential signal to sell.

Bullish And Bearish Candlestick Patterns Pdf Candle Stick Trading Pattern

13. Closing Marubozu Candlestick Pattern. Definition: The Closing Marubozu Candlestick Pattern is a long candle with no or a very short upper shadow and no lower shadow.If bullish, it closes at its high; if bearish, at its low. This pattern indicates a strong commitment from buyers or sellers throughout the trading session.

Using 5 Bullish Candlestick Patterns To Buy Stocks

We will focus on five bullish candlestick patterns that give the strongest reversal signal. 1. The Hammer or the Inverted Hammer. The Hammer is a bullish reversal pattern, which signals that a.

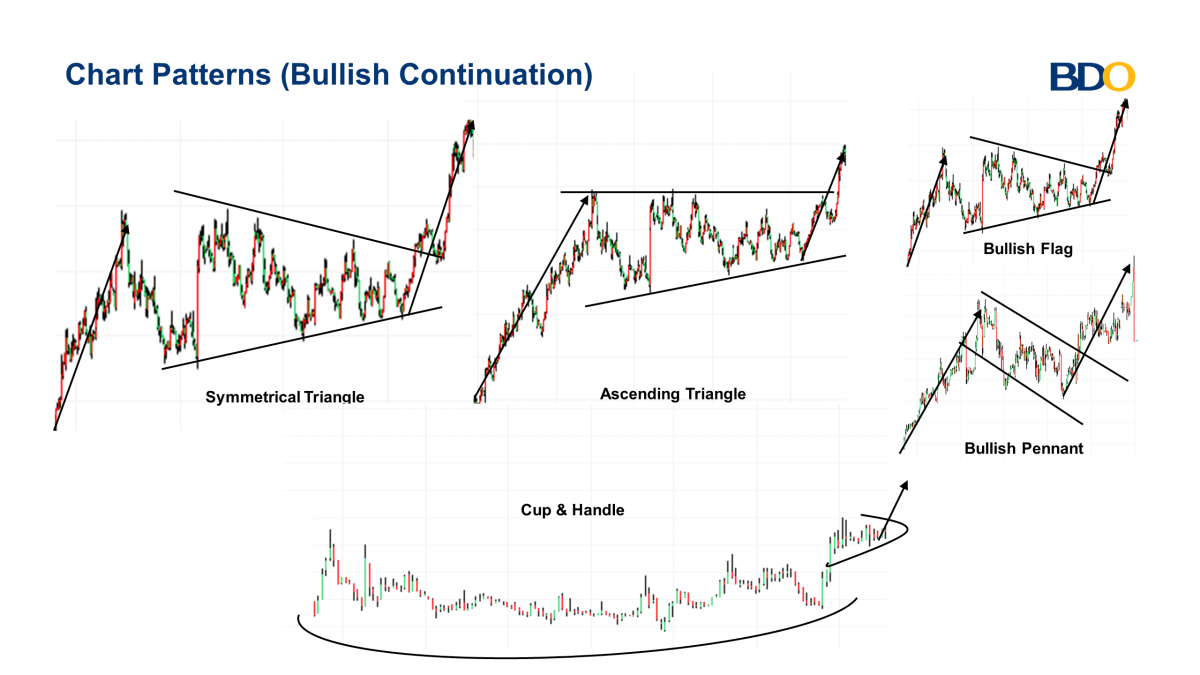

Bullish and Bearish Continuations BDO Unibank, Inc.

A 1-candle pattern. It can signal an end of the bearish trend, a bottom or a support level. The candle has a long lower shadow, which should be at least twice the length of the real body. The color of the hammer doesn't matter, though if it's bullish, the signal is stronger. Hammers occur frequently and are easy to recognize.

Bearish Reversal Candlestick Patterns The Forex Geek

Bullish pattern is confirmed when price crosses above its moving average. Wedges. Bullish or Bearish: A Continuation Wedge . consists of two converging trend lines. Like a Triangle, but its apex slants downwards at an angle. As it forms over time, volume diminishes and trend appears downward, but long-term range is still upward. Bullish pattern is

Bearish & Bullish Reversals BDO Unibank, Inc.

Bullish Patterns. There are dozens of popular bullish chart patterns. Here is list of the classic ones: Bull Flag. Bull Pennant. Inverted Head and Shoulders. Ascending Triangle. The following chart setups based on Fibonacci ratios are very popular as well: Bullish Butterfly.

Chart Patterns B.P. RISING

The Evening star pattern is a bearish reversal candlestick pattern. When the evening star candlestick pattern forms an uptrend, it signals that the trend will change. The evening star candlestick consists of 3 candles. The first is a bullish candle, the second is doji, and the third is a bearish candle representing the seller's power.

Bullish And Bearish Reversal Candlestick Patterns Candle Stick

Bearish Patterns. There are dozens of popular bearish chart patterns. Here is list of the classic ones: Bear Flag. Bear Pennant. Head and Shoulders. Descending Triangle. The chart setups based on Fibonacci ratios are very popular as well: Bearish Butterfly.

What Is Bullish Or Bearish Candle Stick Trading Pattern

1. Strong Trend Confirmation: Flag patterns are predominantly seen as continuation patterns. When traders spot a flag formation after a significant price movement, it reinforces the belief in the strength and momentum of the prevailing trend.

Candlestick Pattern Cheat Sheet Free Download

10 Most Essential Advanced Chart patterns Final Word Advanced Cheat Sheet Candlestick Patterns Download (PDF File) Below, you can download for free our advanced cheat sheet candlestick patterns categorized into advanced bullish bearish candlestick patterns: Advanced Cheat Sheet Candlestick Patterns PDF [Download]

Candlestick Pattern Cheat Sheet Pdf Download Cheat Sheet

Bullish Engulfing: The bullish engulfing pattern forms when a green candle completely engulfs a bearish candle. More clearly, in this pattern, the green candle (bullish candle) completely covers or, we can say, engulfs the red candle (bearish candle). Hammer: The hammer candle is a single candlestick pattern.

Bullish and bearish belt hold candlestick patterns explained on E

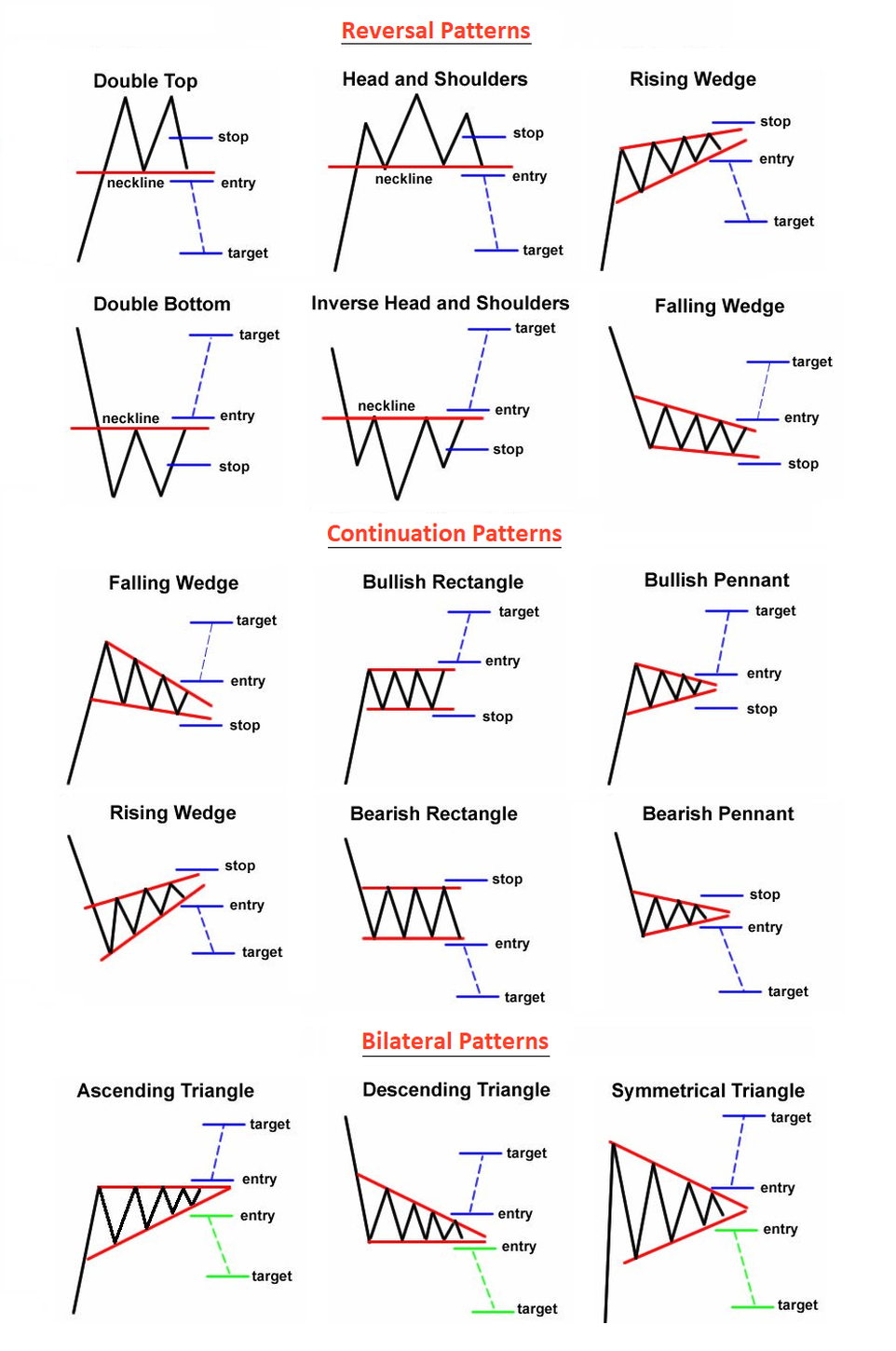

What are Chart Patterns Classic Chart Patterns Double Tops Double Bottoms Head and Shoulders Pattern Forex Chart Patterns Bullish Flags Bearish Flags Symmetrical Triangle Stock Chart Patterns Rectangle Patterns Channel Patterns Chart Patterns Cheat Sheet Most Profitable Chart Patterns Lastly What are Chart Patterns

How to read candlestick patterns What every investor needs to know

The bullish breakaway pattern is usually formed at the end of a bearish move. This pattern is a trend reversal and translates into a bullish trend. However, there is a chance that the trend might not reverse quickly, and ideally, the trader should wait till a larger green candle appears to confirm this pattern.

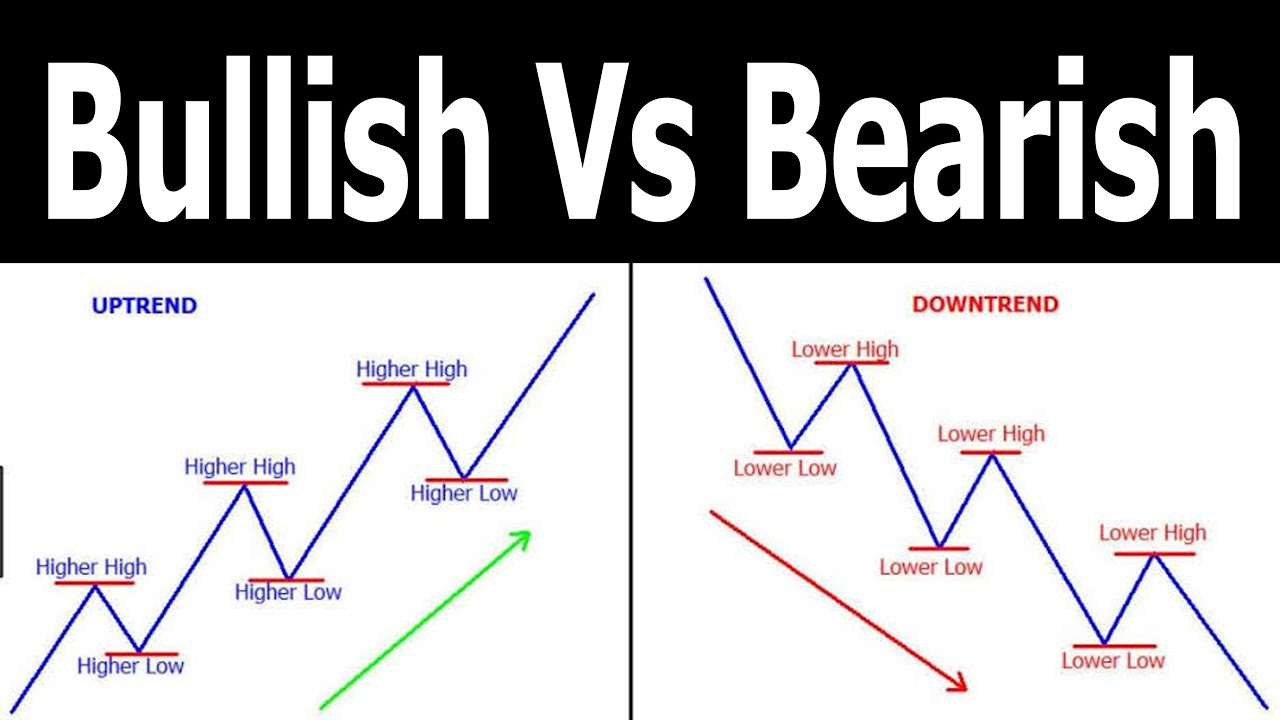

Bullish VS Bearish What’s the Difference Techno FAQ

A doji represents an equilibrium between supply and demand, a tug of war that neither the bulls nor bears are winning. In the case of an uptrend, the bulls have by definition won previous battles because prices have moved higher. Now, the outcome of the latest skirmish is in doubt. After a long downtrend, the opposite is true.

Bullish And Bearish Candlestick Charts Candle Stick Trading Pattern

List of top 19 chart patterns There are several repetitive chart patterns in the technical analysis, but here I will explain only the top 24 chart patterns. These patterns have a high winning probability. Double top The double top is a bearish reversal chart pattern that shows the formation of two price tops at the resistance level.

Bull and Bear Candlestick Patterns Day Trading Posters Etsy

Japanese candlestick patterns are the modern-day version of reading stock charts. Bar charts and line charts have become antiquated. Candlesticks have become a much easier way to read price action, and the patterns they form tell a very powerful story when trading. Japanese candlestick charting techniques are the absolute foundation of trading.